When you select the service button you will be presented with a number of alternatives from which to pick. The legal heirs of a deceased person may request cancellation of the registration on their behalf.

Everything About Gst Registration Of A Private Limited Company Ebizfiling

If you wish to apply for the SST Deregistration process you will need to provide a letter of authorization to the Customs Department.

. Other ways to do this You can also cancel your GST registration by sending us a message in myIR or calling us on 0800 377 776. Individuals who have been assigned a taxpayer identification number Taxpayers who are also enrolled as tax deductors or Tax collectors. Enter the GSTIN Number.

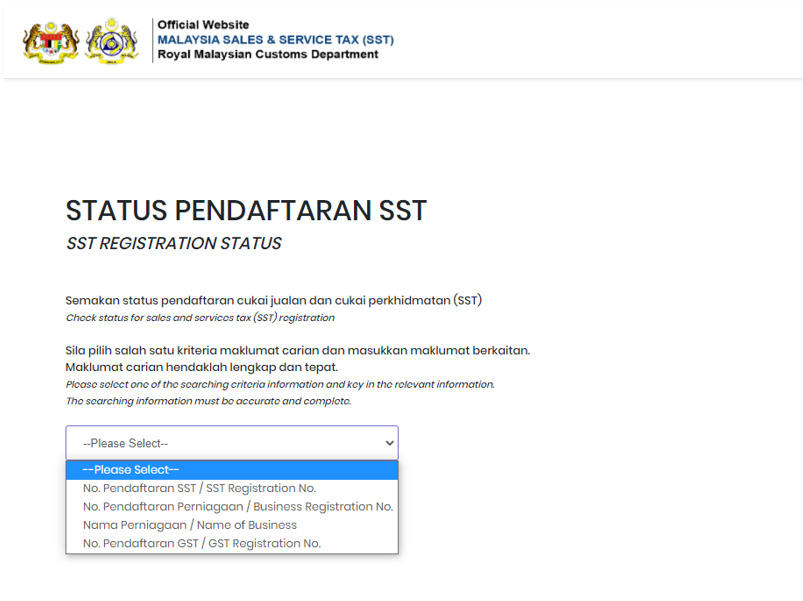

Making a proposal in bankruptcy is not the same as filing for bankruptcy. Check the status of your GST Registration application. There are circumstances where the Cancel GST Registration needs.

If the structure of the firm changes the GST must be canceled. The reasons for the appeal must include the following. First go to the GST official website to file an application then log in into the portal.

Incorrect MSIC code used. In this regard liability is important and is to be mentioned. If you make a proposal in bankruptcy in other words a payment arrangement with your creditors to prevent bankruptcy your GSTHST account will not be closed automatically.

Navigate to the GST Portal. The small-supplier threshold for mandatory GSTHST registration begins on the day immediately after the assignment into bankruptcy. No guesswork our Tax Professionals can answer your questions.

Afterward select the service option. Check the status of your GST Registration application. How to cancel GST registration online.

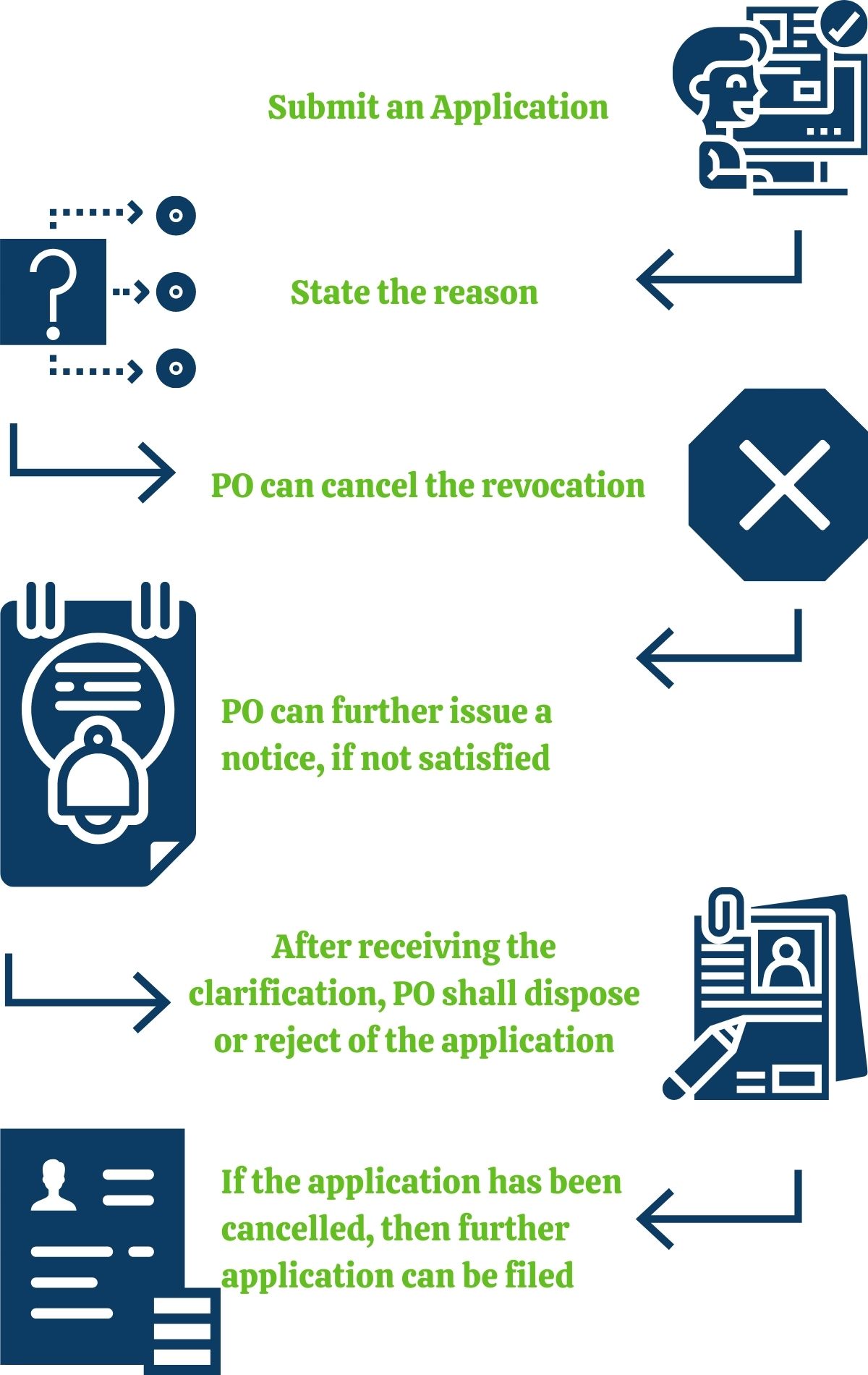

The GST can be canceled if the business is closed down for any reason or if it is completely transferred owing to the death of the single proprietor or company owner or if it merges with another firm. For cancellation this category of taxpayers has to electronically submit an application through Form GST REG-29 on the GST website. The registered person has contravened the provision of the act.

By phone on 13 28 66 between 800am and 600pm Monday to. The stepwise guide on how to activate cancelled GST Registration is as follows. STEP 1 Go to the site httpswwwgstgovin.

Suo-Moto Cancel GST Registration. The registered person under GST does not conduct any business from the declared place of business or. A Step by Step GST Cancellation process.

How to cancel GST registration online. Enter the ARN Number. In case of a voluntary GST cancellation or cancellation on account of the death of the assessee one can visit the GSTN portal to initiate the cancellation of GST registration.

You will be then directed to Form REG-16 where you will be asked to fill in info such as Basic Details Verification and Cancellation Details and more. Steps for cancellation of GST registration online on GST portal. A GST registration can be canceled by an officer if.

You need to return the GST of the value of the asset in your final GST return regardless of the accounting basis you use. Start your GST Cancellation. Use the GST registration form to provide the information required.

At the time of registration cancellation inputs semi-finished goods and finished goods were held in stock. How to Cancel GST Registration. How to cancel your GST registration.

Cancel your ABN anor Business Name if needed on the same form. The registered person can reply to the show cause notice within the prescribed time. The taxpayers must not have issued any GST invoice after their registration or the business owners death.

If the person having GST registration has not filed GST returns for six months. Registrants can cancel their accounts of their own volition or at the request of the GST department. STEP 2 Click on Login and enter appropriate login credentials.

Through Online services for business. Form GST REG 16 should be used to file a cancellation request. Form GST REG 16 must include the following information.

Prior to the cancellation of registration the officer would issue a notice to such person whose GST registration is liable to be cancelled requiring show cause within seven working days from the date of service of such notice as to why the GST registration should not be cancelled. If you would like to close your business you may also submit an SST Deregistration request. The entire process will take no more than a few minutes.

Reason for Cancel GST Registration. Click on the Registration tab and then select the Application for Cancellation of Registration option under Registration. 1 Getting Ready for GST - Registering for GST 2 Registration revised as at 23 April 2014 3 GST Electronic Services Taxpayer Access Point TAP Handbook 4 Click Multimedia Video for Registration.

You can cancel your GST registration and any other roles or registrations together or separately. After a thorough evaluation of the application the office can approve the cancellation of such migrated taxpayers. FILL OUT AN ONLINE SINGLE FORM.

Who cant cancel their GST registration and file a cancellation request. Issues invoice or bill without supply of goods or services violating the GST ACT or GST rules. Navigate to the GST Portal.

Cancel GST registration that means the taxpayer will not be registered in GST any more business is close or turnover is less than the threshold limit. In the event that a taxpayers GST registration is cancelled he or she is required to file a return known as the final. There are many reasons to cancel GST registration.

Go to GST Portal Step-2. Through your registered tax or BAS agent.

Govche India Private Limited Linkedin

Cancellation Or Surrender Of Gst Registration All You Need To Know

If Place Of Business Is Owned By My Father And Proprietorship Is Owned By Me Then Can I Able To Register For Gst By Uploading Light Bill As Address Proof Of The

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Everything About Gst Registration Of An Opc Ebizfiling

Registering For Gst Video Guide Youtube

Malaysia Sst Sales And Service Tax A Complete Guide

Cancellation Or Surrender Of Gst Registration All You Need To Know

Malaysia Sst Sales And Service Tax A Complete Guide

Benefits Of Gst For Small Business And Startups In India Ebizfiling

Gst Migration Services In India Ebizfiling

When Should A Business Apply For Multiple Gst Registrations All One Needs To Know Ipleaders

How To Apply For Gst And Pan For A Partnership Firm Ebizfiling

Malaysia Sst Sales And Service Tax A Complete Guide

Change Your Gst Registration Status Xero Central

Gst Registration Return At Rs 499 Gst Consultancy Services Gst Taxation Consultancy Services Gst Taxation Consultancy Gst Consulting Services Gst Registration Services Gst B M Tax Solution North 24 Parganas Id 20584769412

Gst Registration Check How To Check Gstin Validity Indiafilings

Cancel Gst Registration Gstin Registration Cancellation Procedure